Insurance companies are quietly pulling out of certain U.S. regions, and while the news may not be grabbing headlines, it’s causing ripples in communities nationwide. This retreat is not just about dollars and cents; it’s about the shifting realities of climate change, increased disaster risks, and the evolving landscape of insurance regulations. Understanding why these companies are withdrawing can help you navigate the complexities of insurance and prepare for the financial implications. Here are 13 regions experiencing this quiet exodus—plus, a look into what’s really driving insurers away and how it affects you.

1. California’s Wildfire Zones

If you live in California, you know that wildfires have become an annual nightmare. Regions prone to wildfires are seeing insurance companies packing their bags, mainly because the risk of catastrophic loss is too high. In the aftermath of the devastating 2020 and 2021 fire seasons, insurers are finding it financially unsustainable to cover these areas. Homeowners are facing skyrocketing premiums or, worse, losing coverage entirely.

According to a report by the California Department of Insurance, there was a 31% increase in non-renewals in high-risk areas from 2018 to 2020. This trend forces homeowners to seek coverage through the state’s insurance pool, which often comes with higher costs and less comprehensive coverage. If you’re in one of these zones, it’s crucial to evaluate your insurance options and consider fire-resistant upgrades to your property.

2. Florida’s Coastal Communities

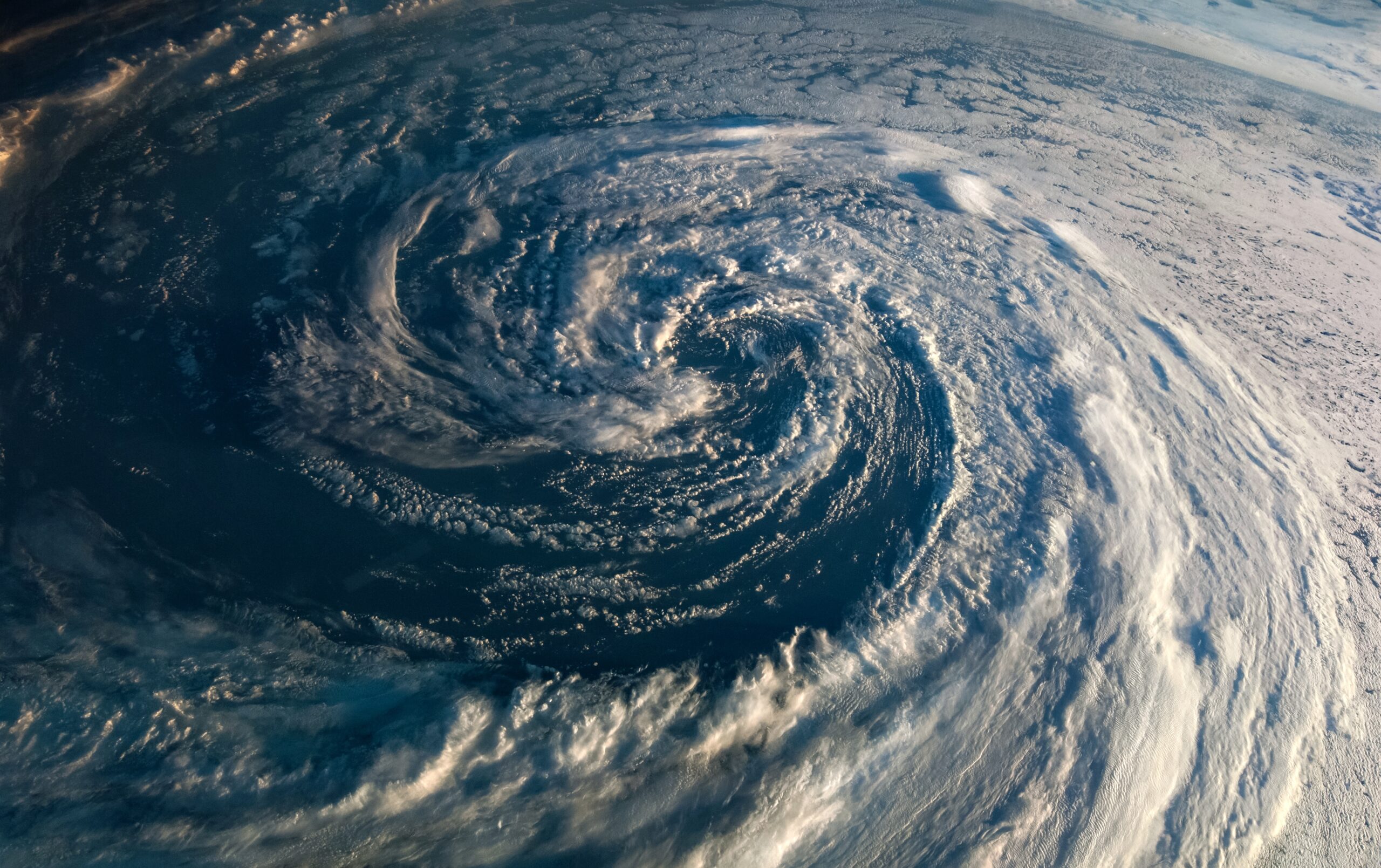

Florida’s picturesque coastline is a paradise, yet it’s becoming a risky business for insurers. With the increasing frequency of hurricanes and rising sea levels, underwriting home insurance in these areas is becoming less attractive. The cost of claims, which can skyrocket after a major storm, is a significant deterrent for insurance companies. As a result, some insurers are choosing to reduce their exposure by pulling out entirely.

For many Floridians, this means confronting higher premiums and limited options. Some residents are turning to the state-backed insurer of last resort, which is generally more expensive and offers less coverage. Living near the ocean is alluring, but understanding the true cost of insurance is crucial for financial planning.

3. Texas’s Flood-Prone Regions

In Texas, it’s not just hurricanes that are causing concern but also the increasing incidents of severe flooding. Areas like Houston have seen catastrophic floods in recent years, making it a hotspot for insurance companies reconsidering their presence. The cost of flooding claims has been on the rise, prompting insurers to reassess their risk models. As a result, many companies are opting to exit these markets.

According to the Insurance Information Institute, the 2017 Hurricane Harvey alone resulted in $19 billion in insured losses, with much of that due to flooding. This has spurred insurers to be more cautious about offering policies in flood-prone areas. If you live in these regions, it’s essential to explore additional flood insurance options and incorporate flood-resistant features into your home.

4. Louisiana’s Hurricane Alley

In Louisiana, hurricanes are not just a weather pattern but a way of life. However, the increasing intensity and frequency of these storms are driving insurance companies away. The sheer volume of claims following major hurricanes like Katrina and Ida has made the region less appealing for insurers. As a result, policyholders are grappling with higher premiums and reduced coverage options.

For many Louisiana residents, the state’s insurer of last resort is becoming a common fallback, despite its limitations. Dealing with these changes requires a proactive approach, including regular reviews of your coverage and exploring all available options. Understanding your policy’s fine print can save you from unexpected surprises when disaster strikes.

5. New York’s Vulnerable Coastal Areas

New York might not be the first place you associate with hurricanes, but its coastal regions face serious risks. Superstorm Sandy in 2012 served as a wake-up call for both residents and insurers. The cost of rebuilding and repairing after such events has insurance companies reevaluating their stakes in these areas. Consequently, some are choosing to withdraw to mitigate future financial losses.

A study by Columbia University highlights the projected increase in sea level rise, which only adds to the vulnerability of these coastal communities. Residents are now finding themselves with fewer insurance choices and potentially higher premiums. Preparing for these changes means staying informed about both your coverage and potential environmental threats.

6. Nevada’s Earthquake-Prone Regions

Earthquakes might not be top of mind in Nevada, but the state sits on a network of fault lines. Insurers are wary of the unpredictable nature of earthquakes, which can cause massive destruction. With the potential for significant claims, some companies are backing away from offering coverage in these areas. For homeowners, this means facing limited insurance options and potentially higher costs.

Navigating insurance in an earthquake-prone region requires diligence. You may need to consider specialized earthquake insurance, which can be costly but crucial for peace of mind. Understanding the seismic risks in your area and how they impact insurance can help you make informed decisions.

7. Oklahoma’s Tornado Alley

Tornadoes are synonymous with Oklahoma, and their unpredictability makes them a nightmare for insurers. Each year, these violent storms leave a trail of destruction that leads to hefty claims. This financial burden has prompted some insurance companies to reconsider their operations in the region. As a result, residents are seeing fewer choices and potentially higher premiums.

A report from the National Oceanic and Atmospheric Administration highlights the increased frequency of tornadoes in recent years, further complicating insurance offerings. If you reside in Tornado Alley, it’s essential to regularly review your policy to ensure adequate coverage. Investing in storm-resistant home improvements can also help mitigate risks and potentially lower your premiums.

8. Michigan’s Great Lakes Shoreline

The Great Lakes are a stunning part of Michigan’s landscape, but the region’s unpredictable weather patterns pose challenges for insurers. From harsh winters to flooding, the risks are diverse and significant. Insurance companies are finding it tough to balance the potential losses with affordable premiums, leading some to exit the market. This leaves residents with fewer options and the necessity to pay more for comprehensive coverage.

Navigating insurance in this region requires a proactive approach. Staying informed about the latest weather patterns and understanding how they impact your coverage is vital. Additionally, investing in home improvements that can withstand extreme weather can help reduce potential claims and keep your premiums in check.

9. Alabama’s Gulf Coast

Alabama’s Gulf Coast boasts beautiful beaches, but its susceptibility to hurricanes is a constant concern. The increasing severity of storms has made it challenging for insurers to sustain operations here. Many companies are pulling back, leaving residents with limited coverage options. This shift is forcing homeowners to face the reality of higher premiums and less favorable terms.

For those living on the Gulf Coast, understanding your insurance policy’s details has never been more critical. Exploring various insurance options and considering state-supported programs can help bridge the coverage gap. Staying prepared for hurricane season with emergency plans and home reinforcements is also essential.

10. Colorado’s High-Risk Fire Areas

Colorado’s stunning landscapes come with a hidden risk: wildfires. The state has experienced an uptick in these devastating events, prompting insurers to reconsider their involvement. The combination of high costs and increasing claims has led some companies to retreat from high-risk fire zones. This leaves homeowners facing the dual challenge of securing coverage and mitigating wildfire risks.

If you reside in these areas, it’s crucial to prioritize fire safety measures and explore all available insurance options. Investing in fire-resistant home improvements can make a significant difference in your premiums. Regularly reviewing your coverage and staying informed about regional fire risks is essential for protecting your home and finances.

11. Missouri’s Flood Plains

Missouri’s position along major rivers makes it vulnerable to flooding, a concern for both residents and insurers. The increasing frequency of severe weather events is leading some insurance companies to reconsider their presence in the region. With rising claims costs and potential for significant losses, insurers are opting to reduce their exposure. This shift results in fewer options and higher premiums for homeowners.

Preparing for these changes means understanding your flood risk and seeking appropriate coverage. The National Flood Insurance Program (NFIP) can be an essential resource for those in high-risk areas. Investing in flood mitigation measures can also help protect your home and potentially reduce insurance costs.

12. New Jersey’s Storm-Sensitive Areas

New Jersey’s proximity to the Atlantic Ocean makes it susceptible to storms, including hurricanes and nor’easters. The damage from these events can be extensive, prompting insurers to reassess their commitments in the region. The financial strain of frequent claims has led some companies to withdraw, leaving residents with fewer choices. For policyholders, this means facing increased premiums and limited coverage options.

Understanding your risk and exploring all available insurance options is vital if you’re in these storm-sensitive areas. Investing in home reinforcements and emergency preparedness can also mitigate potential damage. Staying informed about regional storm patterns and how they affect your coverage is crucial for your financial well-being.

13. Arizona’s Desert Flash Flood Zones

Arizona’s desert climate might not seem prone to flooding, but flash floods are a real and dangerous threat. This has led insurers to be cautious, with some opting to withdraw from high-risk areas. The unpredictability and potential for significant damage make it challenging to offer affordable coverage. As a result, residents are facing higher premiums and fewer insurance options.

If you call Arizona’s flash flood zones home, it’s essential to understand your risk and ensure your coverage is adequate. Flood insurance, while an additional cost, is crucial for protecting your home and belongings. Staying prepared with an emergency plan and flood mitigation measures can make a significant difference in safeguarding your property.